The wireless industry is maturing and will make prepaid services and mobile broadband more important for profits, notes the latest PwC North American report. Voice usage is declining while data usage is increasing. Prepaid is growing for customers who want to save money and not make a commitment.

The wireless industry is maturing and will make prepaid services and mobile broadband more important for profits, notes the latest PwC North American report. Voice usage is declining while data usage is increasing. Prepaid is growing for customers who want to save money and not make a commitment.

The main problems in the wireless industry are the subsidizing of expensive smartphones and high competition to keep subscribers, noted the report.

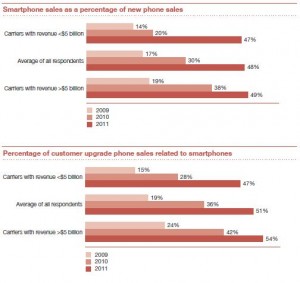

Smartphone sales represented 48 percent of total device sales and accounted for 51 percent of upgrades. Prepaid services now represent an average of 29.2 percent of total service revenues, up from 22.5 percent in the 2010 survey.

The survey found that voice is declining due to data, text and email. The average minutes of use (MOU) per postpaid subscriber has seen a significant decline, shrinking from 720 MOU per month in 2010 to 638 MOU per month in the 2011 survey.

The industry has excellent data coverage. In the 2011 survey, 82 percent of responding carriers indicated that at least 90 percent of their subscriber base was covered by 3G technology, up from 67 percent in the 2010 survey. In the 2011 survey, seven operators indicated that they are deploying 4G technology, up from just three companies in the prior year survey.

Carriers are starting to shut legacy networks and force customers to migrate to new technologies. Hays, U.S. advisory wireless leader at PwC predicts that operators are expected to pursue new partnerships that create greater value for customers and consider network sharing agreements in order to prevent network redundancy.

Prepaid services now represent an average of 29.2% of total service revenues, up from 22.5% in the 2010 survey. The significant growth in the prepaid subscriber base is thought to be attributable to the combination of a maturing market, with mobile subscriber penetration recently nearing 100%, and recessionary consumer purchasing behaviors, which have evolved toward mobile services that allow more careful control of spending.

The full report is available at: www.pwc.com/us/wirelesssurvey.

The 2011 survey results reflect the participation of eight US companies, including three of the four largest wireless operators by revenue and subscriber base, as well as four major Canadian wireless companies, including the three largest. The breadth of coverage and participation enables the survey to provide the most representative summary of industry performance, policies, and practices available for North America. We invite you to explore these h